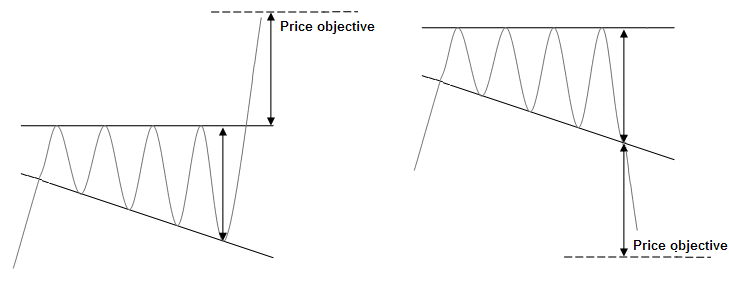

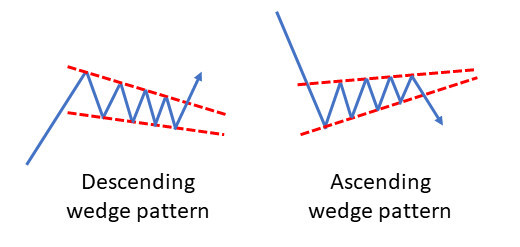

Occurs frequently within financial markets Both patterns present favourable risk to reward ratios as they generally precede big movesĪdvantages and Limitations of the Falling Wedge Advantages.Both continuation and reversal scenarios are inherently bullish.Additionally, divergence can be observed as the market is making lower lows but the stochastic indicator is making higher lows – this indicates a potential reversal. A stop loss can be placed below the recent swing low, while the target can be placed according to the measurement technique discussed above or at a previous level of resistance - while adhering to positive risk to reward ratio.Ĭonfirmation: Traders can look to the volume indicator to see higher volume (greater conviction) in the move up. A break and close above the resistance trendline would signal the entry into the market. Traders can use trendline analysis to connect the lower highs and lower lows to make the pattern easier to spot. Price action then start to trade sideways in more of a consolidation pattern before reversing sharply higher. The USD/CHF chart below presents such a case, with the market continuing its downward trajectory by making new lows. Traders can make use of falling wedge technical analysis to spot reversals in the market. The top end of the line will be the target. Then, superimpose that same distance ahead of the current price but only once there has been a breakout. Traders can look to the starting point of the descending wedge pattern and measure the vertical distance between support and resistance. Setting the stop loss a sufficient distance away allowed the market to eventually break through resistance (legitimately) and resume the long-term uptrend. Traders can place a stop below the lowest traded price in the wedge or even below the wedge itself. The fakeout scenario underscores the importance of placing stops in the right place – allowing some breathing room before the trade is potentially closed out. This is a fake breakout or “fakeout” and is a reality in the financial markets. In the Gold chart below, it is clear to see that price breaks out of the descending wedge to the upside only to return back down. Connecting the lower highs and lower lows will reveal the slight downward slant to the wedge pattern before price eventually rises, resulting in a falling wedge breakout to resume the larger uptrend. The descending wedge pattern appears within an uptrend when price tends to consolidate, or trade in a more sideways fashion. Look for break above resistance for a long entryīelow are various ways to trade the falling wedge using technical analysis:.Oversold signal can be confirmed by other technical tools like oscillators.Look for divergence between price and an oscillator like the RSI or stochastic indicator.The two lines will slope downwards and converge Link lower highs and lower lows using a trend line.A falling wedge is a continuation pattern if it appears in an uptrend and is a reversal pattern when it appears in a downtrend. The differentiating factor that separates the continuation and reversal pattern is the direction of the trend when the falling wedge appears. Both scenarios contain different market conditions which must be taken into consideration. The falling wedge pattern is interpreted as both a bullish continuation and bullish reversal pattern which gives rise to some confusion in the identification of the pattern. Traders ought to know the differences between the rising and falling wedge patterns in order to identify and trade them effectively.

The rising wedge pattern is the opposite of the falling wedge and is observed in down trending markets.

It is considered a bullish chart formation but can indicate both reversal and continuation patterns – depending on where it appears in the trend. The falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines.

This article provides a technical approach to trading the falling wedge, using forex and gold examples, and highlights key points to keep in mind when trading this pattern. The falling wedge pattern (also known as the descending wedge) is a useful pattern that signals future bullish momentum.

0 kommentar(er)

0 kommentar(er)